Non Custodial vs Custodial vs Aggregator vs Bridge: The Complete Crypto Swap Guide

Introduction

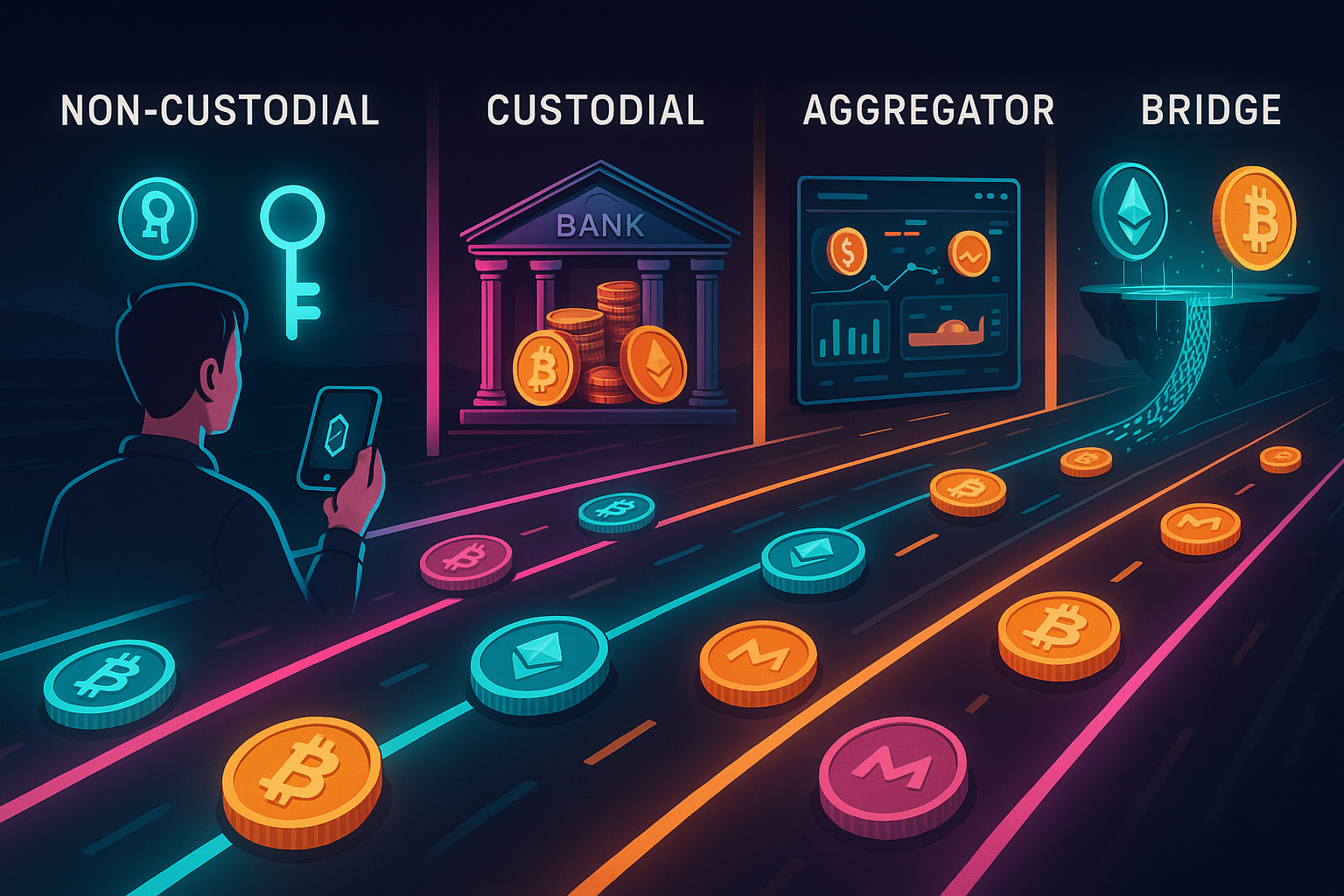

The way you move and trade your crypto matters as much as the assets you choose. Whether you are swapping tokens on the same chain or moving value across different blockchains, you will often face a choice: non custodial vs custodial vs aggregator vs bridge. Each option handles your assets, privacy, and risk in very different ways.

This guide breaks down how these models work, where they are strongest, and where they are weakest, so you can decide what is right for your specific use case. If you want an even deeper comparison of non custodial vs custodial vs aggregator vs bridge swap methods, there are specialized resources that walk through concrete examples of each approach in practice.

By the end of this article, you will understand the tradeoffs between custodial exchanges, self-custody wallets, swap aggregators, and cross-chain bridges, and how to build a workflow that maximizes security, privacy, and convenience.

Why This Matters

At a high level, crypto is about self-sovereignty and programmable money. In practice, the way you interact with crypto infrastructure affects:

- Ownership: Who actually controls your private keys and funds.

- Security: Who is responsible if something goes wrong.

- Privacy: How much personal and transaction data is exposed.

- Costs: Gas fees, spreads, and platform fees.

- Speed and UX: How quickly and easily you can complete swaps and transfers.

Choosing between non custodial vs custodial vs aggregator vs bridge is not simply about technology. It is about aligning tools with your risk tolerance, regulatory constraints, trading style, and long term strategy.

Key Definitions

What Is a Custodial Service?

A custodial service is any platform that holds your crypto on your behalf. This usually means you have an account with a username and password, and the platform controls the private keys.

Examples include:

- Centralized exchanges (CEX) like Coinbase, Binance, or Kraken

- Some “hosted” wallets offered by exchanges or fintech apps

- Custodial staking and yield platforms

With custodial solutions:

- You trust the platform to keep funds secure and solvent.

- The platform can usually freeze, limit, or reverse activity.

- Compliance and KYC are often mandatory.

What Is a Non Custodial Service?

A non custodial service lets you keep control of your private keys and funds. The platform provides software and smart contracts, but never takes possession of your assets.

Examples include:

- Wallets like MetaMask, Rabby, Ledger Live, Keplr, Phantom

- Decentralized exchanges (DEXs) like Uniswap, SushiSwap, Curve

- Non-custodial swap interfaces that route trades across DEXs

With non custodial services:

- You sign every transaction with your own wallet.

- You are responsible for key management and backups.

- The platform cannot unilaterally take or freeze your funds.

What Is an Aggregator?

A swap aggregator is a non custodial interface that searches many liquidity sources and routes your trade through the best path it can find at that moment.

Typically, an aggregator:

- Scans multiple DEXs and liquidity pools on one chain or across chains.

- Optionally combines multiple routes for a better rate.

- Lets you swap crypto instantly without giving up custody.

Good aggregators focus on optimal pricing, minimal slippage, and user friendly routing, without ever taking control of your assets directly.

What Is a Bridge?

A bridge moves value between two different blockchains or layers, for example from Ethereum to Arbitrum, or from BNB Chain to Polygon.

Bridges usually work in one of two ways:

- Lock and mint: Your tokens are locked on the source chain, and a wrapped representation is minted on the destination chain.

- Burn and release: Your wrapped tokens are burned on the source chain, and the original tokens are released on the destination chain.

Bridges can be:

- Custodial (operated by a centralized entity that holds the locked assets)

- Non custodial (trust-minimized, often using validators, light clients, or advanced cryptography)

Custodial vs Non Custodial: Core Tradeoffs

Custodial: Pros and Cons

Advantages of custodial solutions:

- Convenience: Password resets, customer support, and familiar web or mobile interfaces.

- Fiat integration: Bank transfers, card purchases, and sometimes integrated tax reports.

- Compliance features: Useful for institutions that require KYC and monitoring.

Disadvantages of custodial solutions:

- Counterparty risk: You rely on the platform not to be hacked, go insolvent, or misuse funds.

- Regulatory exposure: Accounts can be frozen or restricted due to policy changes or investigations.

- Limited censorship resistance: Your activity can be halted or blocked unilaterally.

Non Custodial: Pros and Cons

Advantages of non custodial solutions:

- Full ownership: “Not your keys, not your coins” works both ways. With your keys, assets are truly yours.

- Censorship resistance: No centralized account that can be frozen.

- Composability: You can easily connect the same wallet to multiple dApps and DeFi protocols.

Disadvantages of non custodial solutions:

- Self responsibility: If you lose your seed phrase or private keys, no one can restore your funds.

- Complexity: Network fees, gas settings, and signing transactions can be confusing at first.

- Smart contract risk: Non custodial does not mean risk free. Bugs in contracts or protocols can lead to losses.

Where Aggregators Fit In

A swap aggregator sits on top of non custodial infrastructure and helps you:

- Find the best route across many DEXs and sometimes multiple chains.

- Reduce manual work trying different pools and bridges yourself.

- Save on slippage and gas by optimizing trade paths.

Think of an aggregator as your intelligent routing layer. It does not inherently hold your funds if designed as a pure non custodial interface. Instead, it orchestrates calls to underlying smart contracts and lets you sign the final transaction.

Where Bridges Fit In

Bridges primarily solve a different problem: moving assets across ecosystems.

- If you want the best price between two ERC 20 tokens on the same chain, you use a DEX or an aggregator.

- If you want to move from Ethereum mainnet to Polygon, you use a bridge (or an aggregator that integrates bridges).

However, these categories are increasingly blending. Some advanced aggregators now include multi chain routing that effectively acts as a bridge plus swap in a single, non custodial flow.

Benefits of Each Approach

Benefits of Custodial Platforms

- Beginner friendly: Easy for users who are new to wallets and seed phrases.

- Integrated services: Spot trading, margin, lending, staking, and fiat ramps in one place.

- High liquidity: Major centralized exchanges often have deep order books for large trades.

Benefits of Non Custodial Solutions

- Direct control over assets without intermediary custody.

- Better alignment with crypto principles like decentralization and trust minimization.

- Global accessibility: Anyone with internet and a wallet can participate.

Benefits of Aggregators

- Best available pricing: By aggregating multiple sources, they reduce the chance of overpaying.

- Time savings: No need to manually compare DEXs and routes.

- Unified interface: One consistent UX across chains, tokens, and liquidity sources.

- Non custodial swap flow: Many aggregators are designed as a private exchange style experience where your wallet remains in control.

Benefits of Bridges

- Access to new ecosystems: Move assets to chains with lower fees or different dApps.

- Strategy diversification: Deploy capital across many DeFi environments.

- Scalability: Use L2s or alternative chains for cheaper, faster transactions.

Risks and Drawbacks

Risks of Custodial Services

- Platform failure: Hacking, mismanagement, or insolvency can lead to loss of funds.

- Frozen withdrawals: During volatile markets, withdrawal limits or pauses are common.

- Regulatory clampdowns: Jurisdictional changes can affect your access overnight.

Risks of Non Custodial and Aggregators

- User error: Sending to the wrong address, wrong network, or losing seed phrases.

- Phishing and malicious dApps: Fake interfaces or approvals that steal funds.

- Smart contract vulnerabilities: Exploits of DEX, aggregator, or routing contracts.

Using an aggregator multiplies your dependence on underlying protocols. If one component in the route is compromised, your transaction may be at risk. That is why security audits and reputation are crucial factors.

Risks of Bridges

Bridges have historically been some of the most attacked pieces of crypto infrastructure.

- Centralized custody: Some bridges rely on a small set of signers or a single entity that holds locked assets.

- Complex contracts: Cross chain communication logic is complicated, which expands the attack surface.

- Liquidity fragmentation: Multiple versions of “bridged” tokens across chains can confuse users and split liquidity.

Even “trust-minimized” bridges that rely on light clients or advanced proofs carry smart contract and implementation risks, although they remove some centralized trust assumptions.

Step by Step Guide: Choosing Between Non Custodial vs Custodial vs Aggregator vs Bridge

Step 1: Define Your Goal

Clarify the specific job you want to accomplish:

- Buy crypto with fiat

- Swap one token for another on the same chain

- Move assets to a cheaper or different chain

- Execute large trades with minimal slippage

- Preserve privacy and maintain self custody

Step 2: Decide on Custody Model

- If you prioritize simplicity and support, a custodial exchange may be acceptable for small amounts.

- If you prioritize sovereignty and censorship resistance, choose a non custodial wallet and tools.

Step 3: Choose Your Swap Mechanism

Once you have a wallet strategy, decide how to trade:

- For on-chain trades on a single network, consider:

- A popular DEX for straightforward swaps.

- A non-custodial aggregator for best route and pricing.

- For cross chain moves, you need:

- A dedicated bridge between the source and destination chains, or

- An aggregator that integrates bridging plus swapping in one transaction.

Step 4: Evaluate Security and Reputation

- Check audits and security reports for DEXs, bridges, and aggregators.

- Look for transparent documentation on how routes and bridges are selected.

- Search for incident history or unresolved user complaints.

Step 5: Run a Small Test Transaction

- Always start with a small amount when using a new bridge, aggregator, or DEX.

- Confirm that assets arrive correctly before committing larger funds.

- Double check network, token contracts, and recipient address.

Step 6: Optimize for Cost and UX

- Compare gas fees and total cost (including bridge and protocol fees).

- Consider how many steps are required to reach your end state.

- Favor workflows that keep custody with you but reduce complexity, such as a single non-custodial swap interface that handles routing under the hood.

Practical Tips for Using Non Custodial Tools, Aggregators, and Bridges

1. Protect Your Private Keys

- Use hardware wallets for significant funds.

- Store seed phrases offline, never in cloud notes or screenshots.

- Consider multi signature setups for shared or high value accounts.

2. Verify URLs and Contracts

- Bookmark official websites to avoid phishing.

- Check token contract addresses from trusted sources like project websites or reputable explorers.

- Be wary of paid search ads impersonating real platforms.

3. Review Permissions and Approvals

- Periodically revoke token approvals you no longer need.

- Prefer interfaces that let you limit approvals to exact amounts.

- Understand that granting “infinite approval” exposes funds in that token to contract risk.

4. Monitor Bridge Risks

- Favor bridges with strong, public audits and a track record of safe operation.

- Spread large transfers across multiple transactions or bridges when practical.

- Confirm which wrapped token standard is dominant on the destination chain to avoid isolated liquidity.

5. Use Aggregators Thoughtfully

- Understand that the “best price” route might include multiple hops, affecting gas cost and execution time.

- Check minimum received and slippage settings carefully.

- For more efficient and private routing, look for a non-custodial swap interface that emphasizes privacy and smart route selection.

6. Keep a Custodial On-Ramp if Needed

- Many users combine:

- A custodial exchange for fiat on/off ramps, and

- A non custodial wallet and aggregator/bridge stack for day-to-day crypto activity.

- Withdraw to self custody as soon as practical.

How to Decide: Non Custodial vs Custodial vs Aggregator vs Bridge

Here is a concise way to map each tool to the job you need done:

- Use a custodial platform when:

- You are converting large amounts of fiat to crypto and need banking integration.

- You require institutional-grade compliance or reporting.

- You accept some counterparty risk in exchange for service and support.

- Use a non custodial wallet when:

- You care about long term sovereignty over your assets.

- You are interacting with DeFi, NFTs, or on-chain governance.

- You want to minimize censorship and third-party control.

- Use an aggregator when:

- You want the best price and route across multiple DEXs or chains.

- You prefer a single, unified swap interface.

- You want to keep assets in your own wallet during the entire process.

- Use a bridge when:

- You need to move tokens between chains or layers.

- You are chasing specific yields, dApps, or fee environments on another chain.

- You accept the additional smart contract and protocol risk that bridges entail.

Conclusion

The debate around non custodial vs custodial vs aggregator vs bridge is not about choosing a single winner. It is about understanding what each tool is designed to do and how its tradeoffs align with your priorities.

- Custodial platforms emphasize convenience, liquidity, and fiat integration but introduce counterparty and regulatory risk.

- Non custodial wallets and DEXs emphasize self-sovereignty and censorship resistance, at the cost of more responsibility and some complexity.

- Aggregators help you navigate fragmented liquidity and infrastructure, often enabling private, non-custodial swaps with better pricing and UX.

- Bridges unlock multi chain strategies but sit at the frontier of protocol risk and security challenges.

For most users, the optimal setup is a hybrid: use regulated custodial services as on/off ramps, then move funds into self custody and rely on high quality aggregators and bridges for day to day swaps and cross chain moves. As you refine your strategy, revisit your assumptions about custody, privacy, and risk, and benchmark your options against trusted comparisons of non custodial vs custodial vs aggregator vs bridge swap approaches so you can keep improving both safety and efficiency over time.