Stablecoin Transfers Across Networks Fees: Complete Guide for 2025

Introduction

Stablecoins have become the backbone of on-chain trading, yield farming, and cross-border payments. Yet the moment you try to move USDT, USDC, or other stablecoins from one network to another, you quickly run into a confusing problem: stablecoin transfers across networks fees vary wildly and are not always transparent.

Sending the same 100 USDT can cost a few cents on one chain and tens of dollars on another. Different networks, different bridges, and different wallet settings all affect your final cost. On top of that, you have to worry about speed, security, and privacy while keeping your funds under control.

If you are comparing TRC20, ERC20, and Solana or looking for a non-custodial swap that helps you save on fees, understanding how cross‑network transfers work is crucial. This guide walks you through everything you should know before moving stablecoins between chains.

Why Stablecoin Transfers Across Networks Fees Matter

1. Fees Directly Impact Profitability

Whether you are a trader, yield farmer, or simply sending money abroad, every dollar spent on fees cuts into your returns. For active users, the total cost of stablecoin transfers across networks fees over a month or a year can be huge.

- Arbitrage traders trying to capture price differences across exchanges need low costs to stay profitable.

- Yield farmers moving liquidity between chains must keep gas and bridge fees in check to preserve APY.

- Everyday users sending stablecoins as remittances or payments want to avoid losing money to unnecessary blockchain costs.

2. Different Networks, Different Cost Structures

Each blockchain has its own fee mechanics:

- Ethereum (ERC20): Gas fees can be high during congestion but benefit from deep liquidity and wide support.

- Tron (TRC20): Typically very low transaction fees, often fractions of a cent, making it popular for stablecoin transfers.

- Solana: Extremely cheap and fast, but with a different account model and network assumptions.

- Layer 2s (Arbitrum, Optimism, Base, etc.): Usually cheaper than Ethereum mainnet, with separate bridging fees and withdrawal delays.

The network you choose has a greater impact than many people realize. Paying $20 on Ethereum when the same transfer on Tron would cost less than a cent is a major difference in user experience and capital efficiency.

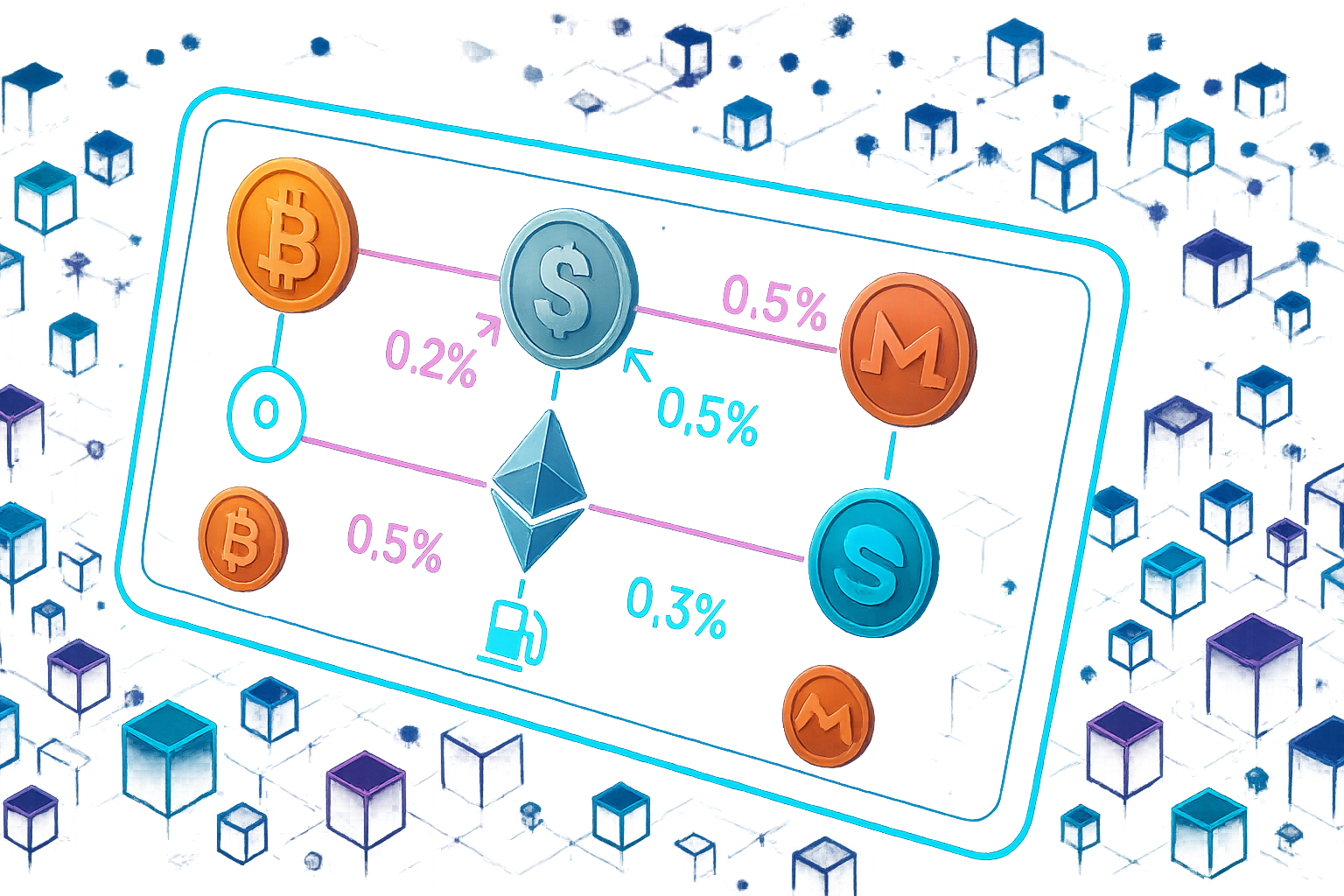

3. Bridges and Exchanges Add Their Own Fees

Beyond on-chain gas or transaction fees, you may encounter:

- Bridge protocol fees (a percentage of the amount or a flat fee)

- Exchange withdrawal fees

- Spread/markup when converting between stablecoin variants or networks

These stack on top of base network costs. Choosing the right route can easily cut your total expense in half.

What Influences Stablecoin Transfers Across Networks Fees?

1. The Blockchain Network Itself

The biggest factor is usually the network where you are sending from or to:

- Ethereum: Gas fees are determined by network congestion and gas price (gwei). Complex transactions like bridge deposits or swaps consume more gas than a simple token transfer.

- Tron: Uses bandwidth and energy; most transfers cost very little. Often used for low-cost stablecoin remittances.

- Solana: Extremely low per-transaction fees, but infrastructure and wallet support differ from EVM chains.

- Other chains (BNB Chain, Polygon, Avalanche, etc.): Typically cheaper than Ethereum, but liquidity and stablecoin variety can vary.

2. Type of Transfer Route

There are three main ways to move stablecoins across networks:

- Centralized exchange routing: Deposit on one chain, withdraw on another.

- On-chain bridge: Use a bridging protocol or cross-chain DEX aggregator.

- Direct chain-to-chain swaps: Through services that let you swap crypto instantly without holding custody of your coins.

Each route has its own fee model, security assumptions, and speed.

3. Token Variant and Liquidity

The same stablecoin brand can exist as different tokens on various chains:

- USDT-ERC20 vs USDT-TRC20 vs USDT-SPL (Solana)

- USDC on Ethereum vs Solana vs Arbitrum, etc.

When you move between chains, you may either be:

- Bridging a wrapped version that represents the original, or

- Swapping into the “native” version on the target chain.

Low liquidity for a particular variant on your destination chain can increase spreads and slippage, effectively adding to your total cost even if gas fees are low.

4. Transaction Size

Stable network fees are often flat or only loosely tied to transaction amount. That means the percentage cost of transferring $50 can be dramatically higher than transferring $5,000.

- Paying $10 in gas to move $50 is a 20% fee.

- Paying the same $10 to move $5,000 is only 0.2%.

Knowing this helps you decide whether it is worth batching multiple transfers into one larger cross-chain move.

Benefits of Transferring Stablecoins Across Networks

1. Lower Fees on Cheaper Chains

One of the biggest advantages of cross-chain movement is escaping high fees:

- Bridge from Ethereum to Tron or Solana, then enjoy ultra-cheap transfers for payments and everyday use.

- Move to a Layer 2 or low-fee chain for trading, then only bridge back to mainnet when necessary.

While you pay something to bridge, the ongoing savings can be well worth it.

2. Access to Better Yield and DeFi Opportunities

Different ecosystems specialize in different things:

- Some chains have deep liquidity for lending/borrowing stablecoins.

- Others offer higher yields on stablecoin farms or innovative options strategies.

- New chains often incentivize liquidity with token rewards.

Effective management of stablecoin transfers across networks fees lets you reposition capital to wherever the best opportunities are, without donating most of your returns to gas.

3. Faster Settlement and User Experience

Fees are not just about cost; they are also about speed and reliability. High-fee networks can mean:

- Delayed transactions when gas is underpriced

- Failed transactions that still cost gas

By shifting to faster and cheaper chains, you may gain:

- Near-instant confirmation times

- Predictable, low fees regardless of market conditions

4. Privacy and Non-Custodial Control

Many users move stablecoins across networks to improve privacy or to avoid holding their funds on centralized exchanges. Using a private exchange or non-custodial swap route can reduce the need to KYC with multiple platforms while keeping your funds in your own wallets.

Risks and Drawbacks of Cross-Network Stablecoin Transfers

1. Bridge and Protocol Security Risks

Bridges are complex smart contracts and infrastructure; historically, they have been frequent hacking targets. Key risks include:

- Smart contract vulnerabilities leading to loss of locked assets.

- Validator or multisig compromise in federated bridge setups.

- Incorrect token mappings or issues with wrapped assets depegging.

Before using any bridge, research:

- Its track record and audits

- How it secures assets and verifies cross-chain messages

- Whether it is permissionless or depends on a small multisig

2. Hidden or Layered Fees

Even if the advertised gas fees look low, you might be paying more than expected due to:

- Bridge or routing fees on top of gas

- Exchange deposit/withdrawal fees

- Slippage and spreads when swapping between stablecoin variants

Always check:

- The estimated final amount before confirming a transfer

- Whether your wallet or interface is displaying all fees clearly

3. Network Congestion and Delays

Cross-chain transfers can be delayed by:

- Congested source or destination chains

- Bridge confirmation times and security parameters

- Withdrawal batching or minimum thresholds on some services

This can be especially problematic for arbitrage strategies or time-sensitive trades.

4. Human Error

Common mistakes can be costly:

- Sending USDT-TRC20 to an ERC20-only address or unsupported network.

- Choosing the wrong chain on an exchange withdrawal page.

- Using an incompatible wallet that does not support your destination chain.

In many cases, these errors cannot be reversed, resulting in permanent loss of funds.

Step-by-Step Guide: How to Move Stablecoins Between Networks While Minimizing Fees

This generic workflow will help you plan low-cost, safer stablecoin transfers across networks.

Step 1: Identify Your Starting and Target Networks

Ask yourself:

- Where are your stablecoins currently stored (Ethereum, Tron, Solana, CEX, etc.)?

- Which blockchain do you need to end up on, and in which stablecoin format?

- Does the destination service (exchange, DeFi protocol, wallet) clearly support that specific token standard?

Clarifying this avoids the number one cause of accidental loss: sending to the wrong chain or token format.

Step 2: Compare Possible Routes

You usually have at least three options:

- Centralized exchange route:

- Deposit your stablecoins to a CEX that supports both networks.

- Withdraw on the desired network (for example, deposit USDT-ERC20, withdraw USDT-TRC20).

- Check both deposit and withdrawal fees and any minimums.

- On-chain bridge:

- Use a reputable bridge that supports your token and networks.

- Verify the official URL and security audits.

- Review estimated gas and bridge fees before confirming.

- Direct cross-chain swap:

- Use a non-custodial swapping service that moves stablecoins from chain A to chain B in one transaction.

- This can simplify routing and often optimizes for lower total cost and speed.

Sometimes, combining routes is optimal, such as swapping to a token with lower bridge fees, bridging, then swapping back on the destination chain.

Step 3: Estimate Total Cost, Not Just Gas

Before you hit confirm, calculate:

- Source chain gas fees for approvals and transactions.

- Bridge or swap fees (percentage and/or flat fee).

- Destination chain gas fees for claiming or final swaps.

- Slippage or spread if a swap is involved.

This gives you a clearer picture of your real stablecoin transfers across networks fees, not just what appears in a single transaction dialogue.

Step 4: Run a Small Test Transaction

Never move your entire balance in one go unless you absolutely must. Instead:

- Send a small amount first to confirm:

- The token arrives on the target chain as expected.

- The receiving wallet or platform recognizes the token correctly.

- Total costs match your estimates.

- Only after a successful test should you send larger amounts.

This is essential when using a bridge or service for the first time.

Step 5: Optimize Timing and Gas Settings

If you are on a network like Ethereum:

- Use a gas tracker to find lower-fee times (like off-peak hours or weekends).

- Select an appropriate gas setting: too low can leave you stuck; too high may waste money.

For chains like Tron or Solana, you usually do not need to worry as much about timing, but it is still worth checking if the network is having issues.

Step 6: Confirm Receipt and Secure Your Funds

Once funds arrive:

- Double-check your new balance and token type.

- Add the correct token contract address to your wallet if needed.

- Think about security:

- Hardware wallet for long-term holdings.

- Careful with approvals for DeFi protocols on the new chain.

Practical Tips to Reduce Stablecoin Transfers Across Networks Fees

1. Choose Cheaper Networks When Possible

If speed and compatibility allow, consider:

- Using Tron or Solana for frequent, smaller transfers.

- Deploying capital on Layer 2s or low-fee EVM chains for DeFi operations.

- Only bridging back to Ethereum mainnet when strictly necessary (e.g., for specific protocols or on-ramps).

2. Batch Transfers and Plan Ahead

Instead of making many small transfers:

- Accumulate funds, then bridge one larger amount to reduce the percentage cost.

- Plan your moves so that you avoid back-and-forth cross-chain hops, which compound fees.

3. Take Advantage of Aggregators and Cross-Chain Tools

Many tools will:

- Scan multiple bridges and routes.

- Estimate final received amounts and total costs.

- Automatically choose an optimized path.

Using these can save both time and money, particularly if you are unfamiliar with all the available bridges for a given token pair.

4. Watch Out for Exchange Withdrawal Options

Centralized exchanges often support multiple networks for the same stablecoin:

- USDT can be withdrawn as ERC20, TRC20, or on other networks.

- USDC might be available on Ethereum, Solana, or certain Layer 2s.

Check:

- Which networks offer the lowest withdrawal fee.

- Which network your destination wallet supports.

- Whether the lower-fee network will still meet your later needs (for example, DeFi access).

5. Prefer Non-Custodial Solutions When Security or Privacy Matters

If maintaining control of your keys and avoiding excessive KYC accumulation are priorities, look for services that facilitate stablecoin transfers across networks via non-custodial routes. A privacy-focused, non-custodial cross-chain tool can shield you from exchange-specific risks while still giving you efficient routing.

Conclusion

Stablecoin transfers across networks fees can be confusing at first, but once you understand the moving parts, they become manageable. Network choice, bridge selection, transaction size, and route optimization all play meaningful roles in determining how much you ultimately pay.

By carefully planning your path, running test transactions, and leveraging tools that prioritize low costs and security, you can shift stablecoins between Ethereum, Tron, Solana, and other ecosystems without eroding your capital. For users who care about staying non-custodial while optimizing cross-chain movement, exploring specialized resources on stablecoin transfers across networks fees is a smart next step.

With deliberate strategy and the right tools, you can enjoy the benefits of multiple chains while keeping fees under control and your stablecoins working efficiently where they matter most.